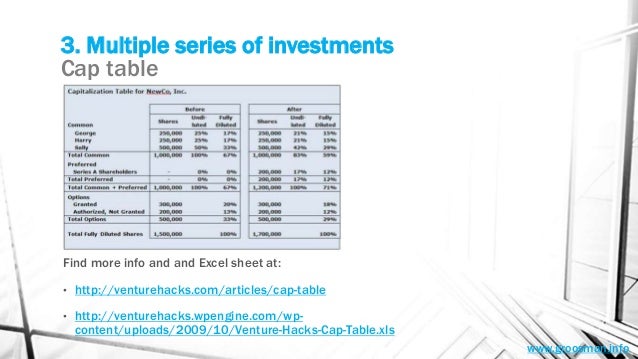

Summary: a cap table lists who owns what in a startup. it calculates how the option pool shuffle and seed debt lower the series a share price. this post includes a fill-in-the-blank spreadsheet you can purchase to create your own cap table.. The pre-seed investors had also required the creation of an options pool of 100,000 (8.07%) options. the creation of this cap table prior to angel investment is more fully discussed in our post on pre-seed investment cap tables for startups. increasing the stock options pool. It covers you for: � initial founder table � angel investment (both as convertible debt which converts at seed stage and straight priced round) � seed investment (assuming 1x strategy preferred liquidation preference) � series a, b and c (again structured as the seed investment) � in addition to the cap table, i have integrated a.

This allows them to purchase shares at $1.00 per share ($10 million cap / 10 million shares outstanding), resulting in the purchase of 2.5 million shares from their seed investment.. New shares are automatically factored into your live cap table the future of fundraising is here imagine an alternate universe, one where 12-18 month funding round cycles are replaced with continuous investment.. �